Navigating the Global Market: Exactly How Offshore Banking and Company Formation Provider Can Assist

In today's globalized economic situation, individuals and businesses are constantly seeking techniques to navigate the complex landscape of the worldwide market. Offshore banking and business development solutions have emerged as useful devices to promote this process. By leveraging the benefits of offshore financial, such as tax obligation optimization, asset defense, and enhanced financial personal privacy, people and businesses can effectively manage their properties and broaden their reach past borders. Business formation services offer advantages such as increased trustworthiness, accessibility to worldwide markets, and structured management procedures. In this conversation, we will certainly discover how these solutions can aid companies and individuals navigate the worldwide market, giving them with an affordable side in an ever-evolving economic environment.

Advantages of Offshore Financial

Offshore banking uses numerous advantages for services and people looking for to optimize their financial approaches and get better financial adaptability. One of the key advantages of offshore financial is raised personal privacy and discretion.

An additional advantage of offshore financial is possession defense. Offshore territories give a safe setting for individuals and businesses to secure their assets from potential lawful cases or creditors. By placing assets in an offshore account, people can shield them from lawsuits, divorce negotiations, or other monetary conflicts that might occur in their home nation.

Additionally, overseas banking offers tax optimization chances. Lots of overseas jurisdictions have desirable tax obligation legislations that allow people and businesses to minimize their tax obligation liabilities legally. By developing an overseas company or account, people can take benefit of tax benefits such as reduced tax rates, tax obligation exemptions, or tax deferments. This can lead to considerable expense financial savings and boosted profitability for businesses or people with high web worth.

Lastly, overseas financial can offer diversity benefits. By holding assets in various territories, individuals can spread their risk and protect themselves from political or financial instability in their home country. This diversity can aid to protect and expand riches over the long term.

Advantages of Firm Formation Solutions

Business development services use an array of benefits for people and services looking to develop a secure and reliable corporate framework. These services provide competence and advice in browsing the complex process of business registration and conformity with local legislations and laws.

Furthermore, company formation solutions can aid businesses and people make the most of tax obligation planning chances. By strategically developing a company in a territory with favorable tax laws, they can reduce their tax liabilities and maximize their earnings. These services additionally provide help in setting up financial institution accounts and getting extra economic services, such as vendor accounts or charge card, which can be vital for performing organization globally.

Additionally, business formation solutions can supply privacy and privacy advantages. By registering a business in a territory that allows for candidate directors and people, businesses and shareholders can protect their identifications and properties from public examination. This can be particularly vital for high-net-worth people or organizations operating in delicate markets.

Tax Optimization Techniques

One critical element to think about when developing a secure and effective corporate structure is carrying out efficient tax obligation optimization strategies. These techniques intend to decrease the tax concern on a firm's earnings while still conforming with all relevant tax regulations. By utilizing overseas banking and firm formation services, businesses can make the most of numerous tax obligation optimization approaches to boost their economic performance.

One typical tax obligation optimization method is making use of tax obligation sanctuaries, which are nations or jurisdictions that use favorable tax plans to bring in foreign investment. These tax sanctuaries commonly have reduced or zero business tax obligation rates, in addition to other tax obligation rewards such as exemptions on capital gains or returns. By establishing an existence in a tax obligation sanctuary through offshore banking and business development services, businesses can take advantage of these useful tax policies.

Another tax optimization technique is transfer pricing, which entails setup rates on deals in between associated entities within an international corporation. By manipulating these costs, firms can shift profits to territories with lower tax rates, reducing their total tax liability (offshore company formation). Nonetheless, it is crucial to make certain that transfer prices methods are in conformity with suitable laws and regulations to avoid possible lawful and reputational dangers.

Furthermore, making use of tax-efficient frameworks such as holding companies or copyright (IP) holding companies can additionally contribute to tax obligation optimization. Holding business can help settle revenues and reduce tax obligation obligations by benefiting from special tax treatments in specific jurisdictions. IP holding business, on the other hand, can aid enhance tax obligations by licensing intellectual home to subsidiaries in territories with reduced tax prices.

Possession Security Techniques

By transferring properties to a trust located in a jurisdiction with positive possession defense regulations, business can protect their wide range from legal claims or prospective lenders. By doing so, the business's proprietors can separate their individual properties from the organization assets, limiting personal responsibility and securing personal riches. By executing these asset security methods, companies can make sure the preservation of their wide range have a peek here and protect versus potential risks in the global market.

Enhancing Financial Privacy

In a period of increasing international unpredictabilities and possible lawful threats, securing financial personal privacy has come to be a pressing problem for business seeking to secure their possessions and decrease risks. have a peek at this site With the surge of digital innovation and the enhancing interconnectedness of the worldwide economic system, the need for enhanced economic personal privacy has become more vital than in the past.

Offshore banking and firm formation services can play a considerable duty in boosting economic privacy. By developing overseas accounts and entities, companies can take advantage of territories that offer robust personal privacy regulations and laws. These jurisdictions typically have strict privacy arrangements that protect the privacy of account holders and investors.

One trick advantage of overseas banking is the ability to keep anonymity. Offshore banks normally operate under strict privacy policies, ensuring that the identification of account holders is kept safe and secure. This can be particularly vital for high-net-worth people and businesses that focus on personal privacy and intend to avoid prospective dangers related to public exposure.

Furthermore, overseas company development services can supply added layers of privacy and security. By including in a territory that offers strong company privacy legislations, firms can shield their financial tasks from spying eyes. This can aid stop rivals, financial institutions, or plaintiffs from accessing to sensitive monetary information.

Conclusion

To conclude, overseas banking and company development solutions provide many advantages such as tax optimization, property protection, and improved economic personal privacy. These solutions allow individuals and organizations to navigate the worldwide market better and efficiently. By making the most of offshore financial and business development, individuals and organizations can enhance their financial techniques and secure their possessions. These solutions provide beneficial tools for navigating the intricacies of the international market.

By developing an offshore firm or account, people can take benefit of tax advantages such as reduced tax obligation rates, tax exceptions, or tax deferments. By additional resources establishing an existence in a tax obligation haven with overseas financial and firm development services, businesses can benefit from these advantageous tax policies.

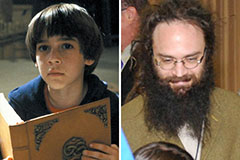

Rider Strong Then & Now!

Rider Strong Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now!